‘Taxes will either remain the same or be less for the majority of Campbell Countians’- Brandon Partin, Property Assessor

By Charlotte Underwood

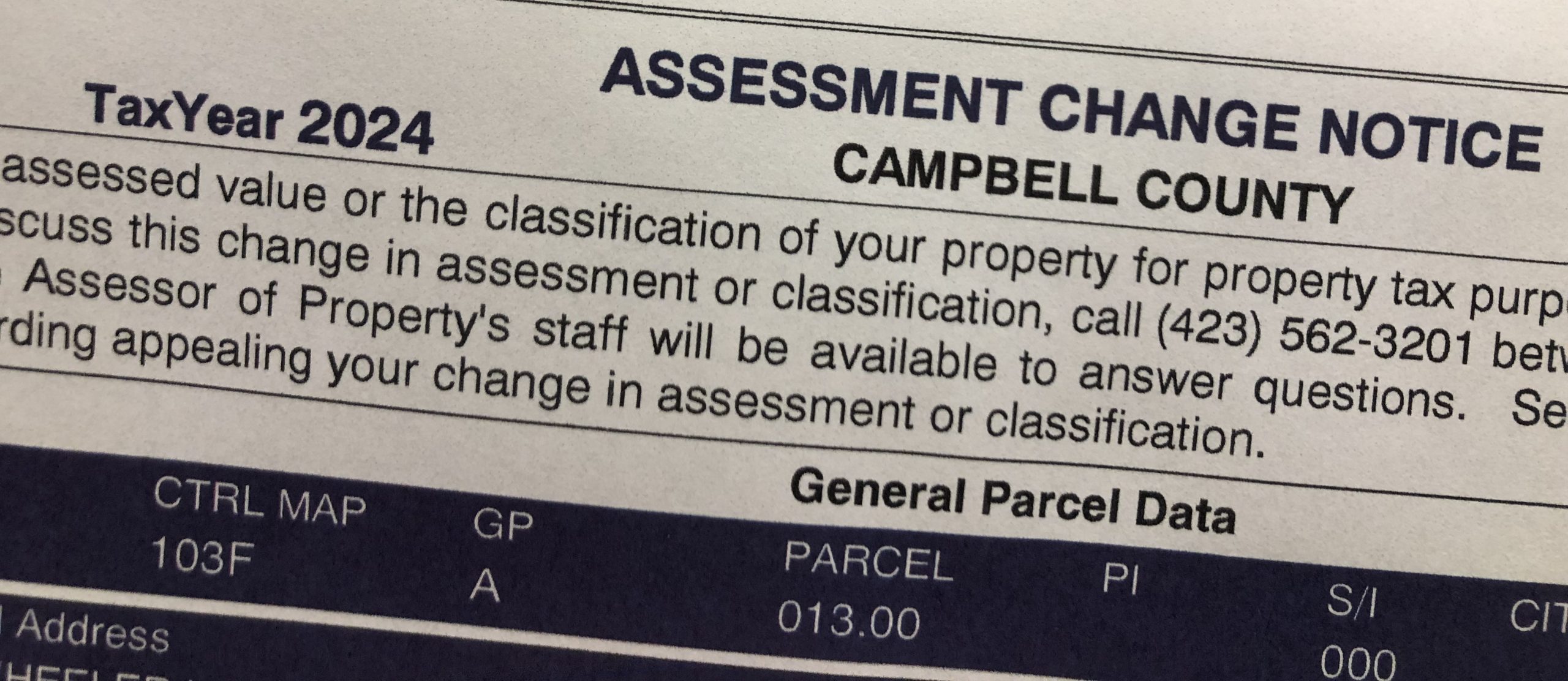

JACKSBORO, TN (WLAF) – The Certified Property Tax Rate has been announced, and the rate has come down from $2.0659 to $1.2156.

What this means for the “majority of Campbell County citizens, is that their taxes will either remain the same or be less,†according to County Property Assessor Brandon Partin. However, for some property owners, taxes may increase, but Partin said “not as drastically as people are thinking.â€

“Like I stated earlier in the year, when the reappraisals went out with the new values even though your value went up, that does not instantly mean your taxes are going up as well. The Certified Tax Rate brings in the same amount of tax revenue as last year’s value did with last year’s tax rate. Now that takes out of play, any growth or new stuff that went on this year, Partin said, explaining that the “county still has a growth in the tax revenue base, but that is something that is typical with every year, not just a reappraisal year…â€stuff that wasn’t being taxed last year, is taxed this yearâ€

The reason the certified tax rate went down is due to a law in the state that says counties cannot “generate a revenue windfall on a reappraisal year.â€

According to Partin, as well as the state comptroller’s office, the certified tax rate is established so that the “local government will bring in just about the same amount of revenue that they brought in before the revaluation was conducted.”

“We have to equalize, so what happens, they look at last year’s tax revenue and they see what the new values are this year, minus the growth and they see what tax rate will generate the same amount of tax revenue off these new values. So, the county does not lose money and it doesn’t make money, it gets the same amount of money that it did last year,†Partin said.

He also gave an example of what the new tax rate would look like for those who did have a significant increase in their valuations. For example, if a house last year was valued at $200,000 on last year’s tax rate, the homeowner paid $1,033 in taxes. If the house’s valuation doubled to $400,000, taxes at the new certified tax rate would be $1,215.60.

“So, even though the valuation doubles, in no way do the taxes double, especially with the lower certified tax rate,†Partin said. (WLAF NEWS PUBLISHED – 07/11/2024-6AM)

.jpg)

Still looks to me that the county is going to get a windfall. Every property owner I know will have their taxes rise by at least 100 dollars. Multiply that by each parcel and that is a lot more money. And now values are starting to drop.